Skift Take

Use our online event budget calculator or event budget template to ensure you keep your event finances on track. From the basics of creating an event budget, right through to pro tips for stretching your event revenues further, we have you covered.

We are sure you will agree that creating and maintaining a comprehensive event budget is one of the most important things you can do for your event. After all, it keeps your event income and expenditure on track.

But it’s also one of the trickiest. Leave something out and you’ve sabotaged your efforts.

Event budgets can be the stuff that nightmares are made of and one of the things that keeps event planners awake at night.

But – it doesn’t have to be like that!

We are here to help you become an event budget pro, EVEN IF you hated math in school and would rather bungee jump than budget.

Itching to get started?

Jump to the speedy online event budget calculator tool.

Or, download and save an event budget template here to use over and over again.

Table of Contents

Part 1: The Basics

What is an

Event Budget

and Why it is

so Important

Definition

The event budget shows the financial position of an event. The actual or projected income and expenditure is detailed within a defined structure.

We can never stress it enough; a sound budget (most of the time) ensures a successful event. The importance of event budgeting must never be underestimated. So why is the event budget such a critical element to get right?

A structured budget is essential because it:

Helps in monitoring costs and understanding what you can (and can’t) afford

Keeps spending decisions under control and focused on priorities, so better economic decisions can be made

Helps to identify where savings can be made if you need to cut back. And the expenditure areas where you cannot meddle.

Determines whether an event is feasible and how great the risks or likely profits are.

Defines measurable and achievable objectives and targets for your event to keep you on the right path from the start

Flags warnings if you don’t hit income targets or are over budget compared to projected expenditure

Can demonstrate the return generated from the event

Is crucial when reporting to management.

Of course, many event planners understand the importance of budgeting in event management but this can be the very reason that some event planners feel overwhelmed by it.

Rest assured – if you read this post, there’s no need for event budgets to be a scary or prohibitive task.

Research

Event Budge Research: Budget Concerns Remain Paramount for Eventprofs

In January 2018 we conducted one of the largest pieces of event planning research ever completed. With 2,400 contacts and over 1,000 respondents

We asked specific questions that pertain to event budgets. We are happy to release the results.

If you would like a copy of this research for publishing you can request it here: State of the Event Industry Research 2018.

Budgets May Rise (a Little)

Most event planners believe that event marketing budgets will remain the same in 2018. 21% are confident that budgets will rise

Event Marketing Budgets Look Hopeful

Although a majority (65%) feel that marketing budgets will remain the same, there is a slight bias in the majority towards increasing budgets

Budget Remains the Biggest Challenge

The vast majority of event professionals signal budget constraints as the single biggest hurdle for 2018. Rising expectations force planners to be innovative. Attendee numbers are also among the most impactful challenges with increased competition being one of the reasons

Shrinking Budgets Are Still a Worry For Eventprofs

Over half of those surveyed said that shrinking budgets were a concern. Although the overall feeling towards budgets is optimistic, there is still a shadow of doubt in several eventprofs’ minds

Staying Within Budget is Key to Event Success

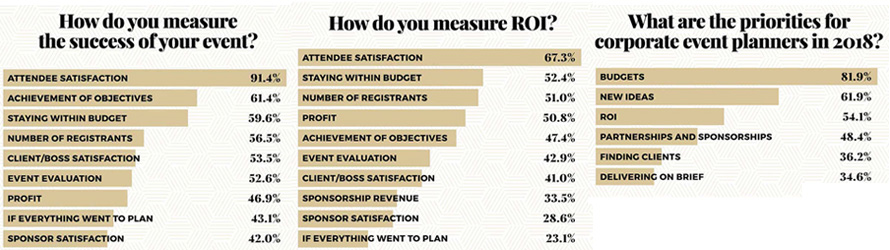

Many factors make up the data used to determine the success of an event. A majority (60%) of event professionals feel that staying within budget is key to measuring success. Almost half (47%) also stated that profit was a factor. Almost a third (32%) indicated that sponsorship revenue was a factor

Staying Within Budget is an Important Factor in Calculating ROI

Over half of those surveyed said that they used budget as an ROI measurement. Almost as many (52%) said they measured ROI with profit and around a third (34%) used sponsorship revenue

Budget is a Top Priority For Corporate Event Planners

81% of corporate event planners surveyed said that budgets were a top priority for the coming year with a majority (54%) also stating ROI as a priority

Event Budget Terms Every Event Planner MUST Know and Understand

Before we get down to the tactics to smash your event budget, we need to ensure we understand the important terms that are critical to truly understanding your event finances. Budgeting is a whole different world with its very own language, which is what can make it so baffling. In order to be understood, particularly when reporting back to your management team, you’ll want to be sure of your use of the following vocab

And once you understand the jargon you can set about calculating these figures to properly understand your real financial position.

Break-even Point

This is the point in the budget where total expenses and total revenue are equal. The event is not losing money or making it at this point. They’ve covered their expenses

Cash Flow

The total amount of money being transferred in and out of the event when taking into account revenue and payouts

In the Black

The goal behind budgeting, this term refers to an event that makes more than it costs to host

In the Red

This is the opposite of “in the black” and means that the event is costing more than it’s making

Gross Budget

This is the total revenue the event is expected to bring in before expenses are deducted. It can also be used as a tally of expenses. That is referred to as the gross expenditures.

Net Budget

The net budget is what is made after all expenditures are paid out. This is a true reflection of the profitability of the event

Fixed Costs

These are often referred to as overhead costs and they are not dependent on things like headcount. If you have a flat rental fee for the venue that is not dependent on the number of guests you have, that’s a fixed cost. Other fixed costs include AV equipment, office space, and room set-up fees

Variable Costs

Variable costs are costs that fluctuate (usually by headcount). Food and beverage is likely a variable cost, as are printing costs. A tally of your fixed costs and your variable costs will yield your total event costs.

Contribution Margin

The contribution margin is the amount that will be contributed towards the fixed costs after the variable costs have been satisfied

Profit Margin

The profit margin measures the total amount by which revenue from event ticket sales, sponsorships, exhibitor sales and so forth, exceeds the costs.

Now we have covered some of the basics, let’s get onto the more advanced guidance.

Part 2: Getting Down to Business - Ace Your Next Event Budget in 9 Easy Steps

Putting together a budget is about more than just expenses for an event. That’s a portion of it but understanding what monies are due when is also a critical component to your success. For instance, if you’re required to have a huge cash outflow in the beginning before registration opens and you begin to take in revenue, your budget will be in the negative and you need to be aware so you can address the issue.

Here is a step by step guide to achieving success in the budget making process:

Determine Event Objectives

Your event objectives define the vision for your whole event, and this includes the event budget. Your objectives help to define your priorities and what your attendees want to see. It can also change the perspective dependent on whether you are running a profit-driven event or a not-for-profit project.

Estimate Revenues

Estimate the different sources of income:

- Event tickets sales

- Sponsorship revenues

- Exhibitor income

- Merchandise

- Food and drink sales

- Other revenues (e.g. fringe events).

Be realistic, do not underestimate, or worse still overestimate income

The estimation of sales could be affected by external factors or internal ones, the difference is that external factors are outside of the control of the organizers (i.e. competition and inflation). The longer the timescale for the forecast, the less precise the figures will turn out to be. Think about key variables and different scenarios and the likely impact this will have on revenues.

Locate and Review Any and All Expenses

Review all areas of your event, starting from the venue contract, to speaker fees, to entertainment and giveaways. Every single element of your event should be added in a budget checklist to make sure it is accounted for

Work out all the likely costs. Break them into fixed costs (those that do not change regardless of how many attend the event e.g. room hire, AV equipment, marketing, office space, salaries) and variable costs (those that vary directly with the numbers attending e.g. catering costs, printing costs, registration fees and charges per attendee)

Understanding the different scenarios of fixed and variable costs will help you determine the margin of contribution of the event. The contribution margin is the amount that will be contributed towards the fixed costs after the variable costs have been satisfied

You’ll need an understanding of how each item will be paid (which we’ll cover more in depth in the cash flow section). Remember every vendor is different, so compiling a master list of every person you work with is a great idea to help keep track and manage your budget at the end of the event

Pro Tip: You may find yourself working with the same vendors over and over. This can be helpful as you will quickly develop an understanding of the particulars of their payment process and may settle on consistent payment terms that can be easily incorporated into each budget.

Set Goals and Measure for ROI

Once you have an overall idea of what your budget should realistically be, plus a master list of all of your vendor contacts, take a step back and measure for ROI

If you’re preparing for a corporate conference and selling attendee passes, monitor how many attendees are registering from the moment you launch the registration page and feed this into your budget. Or, if you’re planning to have sponsors at your event, make sure you strategize creative and detailed packages for each sponsor during the planning process

Will there be an upside on profit from sponsorship dollars? Be sure to account for all areas where you may break even or make a profit from your event – setting goals at the beginning is very important.

Pro Tip: Keep track of what you’re spending from the very beginning. Keep your budget sheet handy at all times, and updated daily to help the event team to stay on budget in real time

If you find items being brought forth that were not on the budget, discussed by the event team, or on the event master plan, bring those items to the attention of your team, and make sure the spend has a purpose. Going over budget is an awful feeling and having to account for items that were not needed and made the event go over budget will always fall back on the event manager. That’s a position no one wants to be in.

Create a “Rainy Day” Event Budget Line Item

The goal of any budget is to spend no more than what’s planned for. A stellar event planner may even come in under what was agreed upon. However, there are occasionally unforeseen items required. Even during those instances, your budget must be on your mind at all times. If you overspend in one area, you need to find an area to trim. A good budget, even when those unexpected costs arise (like hidden costs of moving an outdoor event inside at the last moment), can work like a seesaw, adjusting back to that perfect middle balance

For this reason, many event planners create a small backup budget entry/line item to offset those unexpected costs, usually called a contingency. This might be a set amount or could be a percentage of the total event budget. This money should only be used for absolute event emergencies. Make a list of what those emergencies could be, and ensure your event staff is familiar with the list as well

Pro Tip: Depending on the size of your event the contingency figure might be anywhere between 1 and 25% of the total event budget

Creating checklists and event survival kits for event staff is a creative and useful way to keep everyone on point and in the know before, during, and after any event. This way, if a question comes up where someone on the team needs to make a judgment call on purchasing something not allocated within the budget, they will know if they are making the right decision.

Analyze The Risk and Price Sensitivity of Your Attendees

Consider the likely impact of specific risk factors in terms of your event budget by recording and tracking everything you do and specifically the effect it has on sales. For example:

- how loyal are your attendees. If you increase the ticket price would they still come along?

- how receptive is your target audience to an increased spend on marketing? Does a bigger investment in social media ads give a higher conversion rate?

- what are the returns on running time limited special offers? Does it boost registrations and is it worthwhile?

- would an investment in one element lead to a greater return elsewhere?

Performing sensitivity analysis will also be helpful to understand if it could be good to push on specific factors. For example, will an increase in advertising spend of 10% positively affect the level of sales or not?

The budget can also help you to determine areas where you could save money and cut back, without having a negative effect on the event.

Estimation of Capital Requirement

How much money?

By when?

Two basic questions you need to ask to work out your cash flow and understand if the budget will work or you need to move back to the starting point.

Once you have budgeted sales, costs and investments the capital requirement is the “plug” variable needed to close the budget. Organizers need to consider how much equity (the difference between the value of the assets and the value of the liabilities) is needed for investment into the event, how much capital is needed from lenders, or elsewhere and what are the financial milestones (how much is needed before, during and after the event).

Understand Cash Flow

The ultimate purpose is to have a simple and reasonable income statement, balance sheet and a cash statement that includes all the forecast information related to the event

Delays in obtaining money and paying suppliers can create a shortage of liquidity. That’s why the main suggestion is always to work with revenues and costs but also to think about cash inflows and cash outflows

You want to maximize cash flow, so more detail has to be spent on making accurate forecasts of the cash requirements for a successful event. Think about when payments are due to the venue and your suppliers and when income will be received. For instance, some registration providers pay out on a weekly or monthly basis and sponsors may be given 30-day payment terms

Bulletproof Tactics To Improve Your Cash Flow Today:

- Open bookings as soon as you can to start some revenue rolling in

- Require card payments at the time of booking and eliminate payments by bank transfer, check or on the door

- Select a ticketing provider that pays out revenues on a daily or weekly basis

- sAgree a payment schedule with sponsors so that there is money coming in at regular intervals before the event

- Set short payment terms for payments due to you and extend payment terms for your outgoings. Always negotiate the payment terms if they don’t work for your cash flow

- Go through a credit check with suppliers so that they are happy to accept payment after the event instead of in advance

Establishing the Break Even Point: The Scenarios You Need To Explore To Understand Your Financial Position and Risk

You can work with the anticipated numbers to identify the break-even point, to understand if the event is financially viable or not and link the level of risk with different case scenarios. Using the budget calculator, after you have added in all of the expenditure items you can enter different income scenarios to determine the effect that would have on the event profit or loss

The Income Scenarios You Should Explore:

- Determine a pessimistic budget position. If you didn’t secure any sponsorship revenue, how many tickets would you need to sell to make a profit? Is this even possible within your event capacities?

- If the event has run before add in the ticket sales/price, sponsorship, exhibitor and other revenue from the previous year. If you achieve the same sales this year will you be in profit?

- What are your targets in terms of tickets, exhibitor sales and sponsorship revenue. If you achieve these goals what will you financial position be?

Running these different scenarios can help everyone understand what needs to be achieved. If you run these exercises before your tickets go on sale it may even impact on the final ticket price you publicise or focus the level of discount and negotiation you are willing to give to potential stakeholders

The Top 5 Things For a Sound Event Budget

There are 5 key elements to creating a sound budget for your event and avoiding any unwanted surprises.

Keep it Up to Date

An out of date budget is next to useless. Take time to update your figures regularly, even on a daily basis to stay up to speed.

Ensure it is Accurate

Estimated figures are useful to start building your budget and to act as a placeholder but actual figures need to replace any guesstimates as soon as possible.

Be Realistic

When establishing your budget amounts add in achievable figures. If an amount seems to good to be true it probably is. Add realistic numbers and confirm with a firm quotation as soon as possible.

Be Pessimistic (rather than Optimistic)

Of course, you want to have a sell out event and raise lots of money in sponsorship, however, when it comes to budgeting it is always best to be pessimistic in terms of the projected revenue.

Have a Contingency Amount

Things crop up and you need to be prepared. Try to add a healthy contingency amount to deal with the unexpected, without going over budget.

Part 3: How Much Does it Cost to Run an Event? Making Informed Budget Estimates

As we have covered, the first step in coming up with a comprehensive event budget is to separate expenditures and income. It can be difficult to create an event budget if you have no inkling of the amount each line item will be. The more event budgets you create the easier this becomes but, in the meantime, if you need a starting point, we have listed some of the most common budget items for conferences and shared a minimum to maximum range for what you should expect to pay and receive. By creating an event budget checklist of items you can make sure you have everything covered. We hope this event budget sample is a useful starting guide

If you want to track these quickly and efficiently, start putting figures straight into the online budget calculator.

For an average conference EVENT EXPENDITURES will be:

VENUE

This expense could range from free to thousands of dollars for exclusive use or a luxury resort.

ADVERTISING AND PROMOTION

Free, if you use very basic email and non-paid social media promotion, right through to thousands of dollars for marketing campaigns.

SPEAKERS AND PERFORMERS

Free, if you can find speakers who will present gratis, up to tens of thousands of dollars for well-known keynotes. Performers may also be free all the way up to a million for headlining bands like U2 or Dave Matthews, although we hear he’s not touring anymore but maybe you can talk him into your event.

ACCOMMODATION, TRAVEL AND EXPENSES FOR TALENT

Even in situations where speakers and performers agree to perform for free, you will likely need to pay for their accommodations, travel, rider and expenses ($200 a night per person per room and upwards.

CATERING

Catering can sometimes be part of a sponsorship deal so it won’t cost you anything directly. If you do have to pay, you can expect to pay a lower amount for snack service than for a sit-down meal. (Snack catering would run from around $12 per head upwards. Buffet dinner could be $20-30 a head. Sit-down dinner will likely run to over $45 per person depending on menu choice. Make sure you also factor in food and beverage minimums, open bar, per drink or per person pricing; and table, linen, and other serving rentals.

EQUIPMENT

There’s a lot of equipment used at most events. Factor in things like AV rentals, seating, those mentioned above in catering, booths and anything else you’re not supplying.

TEAM/STAFF

Break this down into an hourly fee based on how many people you’ll need per attendee. Some venues will require union setups, while others will be negotiable.

BADGES

The cost of paper, printing, badge holders/clips if your design them yourself all the way up to several hundred dollars if you outsource, get something bespoke and have custom printed lanyards, etc.

EVENT INCOME might be:

REGISTRATIONS/TICKET SALES

SPONSORSHIP

PUBLIC FUNDS

If they are available to you.

EXHIBITOR REVENUE

Just having these things as a starting point is likely to make you feel better. Now you have a starting point and can control, monitor, and allocate financial weight to each item.

You can use these building blocks as a basis for your own event planning budget worksheet and event cost breakdown template. Or use our FREE budget calculator template which you can download at the end of the post. How nice is that?

Part 4: How to Avoid Common Event Budget Mistakes

The most concerning mistake in an event budget is forgetting to include something, something major. But what are the most common budgeting mistakes? These might surprise you.

Confusing Tools and Goals

Next to the economic and financial data, it is useful to work with some basic ratios or margins. When you talk about budgeting typically you refer to ROI (Return on Investment). This ratio provides evidence of the profitability of an event. The risk is to refuse some good situations because it seems that return on the investment will not satisfy a specific target amount. Many times we’re actually shooting for return on impression or experience in order to get people talking. It is more difficult to see that return immediately.

To avoid this:

- Don’t focus too much on the short term. Think not only about the income strictly related to the event but also to future sources of revenue and opportunity related to the event

- Measure engagement and give it value

- Make sure what you’re measuring reflects your business goals

Too Detailed

“The devil is in the details” is a common way to express the necessity to look deeply at all figures. When you create an event budget do not make the mistake of trying to break the revenues, the costs, cash inflow and cash outflow in too much detail. Instead, make sure you capture the needs and costs as well as payment terms. A budget that is too detailed is difficult to understand and your team may feel intimidated embracing it. If they’re afraid to use it, you can bet that things will not get updated so simple and functional can be better.

Simplify your budget by:

- Using budgeting tools that allow you to control permissions and share in real time

- Creating a template to be adapted for every event you run.

- Using auto-calculating functionalities and simple formulas of most spreadsheets so that there are no taxing sums to be done manually and no need for a calculator

Using the Wrong Tools

Using an Excel file or Google Sheets with some, clear and key headings is an efficient way of building your event budget and makes it easy to share and keep it up to date. It’s not always good to rely on accounting software that you find online which may permit you to create a budget but may not be very easy to manipulate.

Make your life easier by:

- Using an Excel Spreadsheet or Google Sheet that is easy to manage and share

- Give people access who need it but also control their editing abilities if they don’t need to change the numbers

- Keep backups of your budget

Replicating the Past without Learning

Everyone involved in the event budget process should look at each specific case, rather than replicating the past. Think about a new situation with enthusiasm and try to understand key problems related to the budgeting of this specific event

Don’t fallback:

- Personalization is essential in events so each new audience will require slightly different entries. Use a template as a starting point and build from there

- Revisit last year’s budget to see what has changed and what lessons can be learned

- Create weekly budget briefings so you can use your current budget as a roadmap for success next year. Understanding what happened each week leading up to your event will give you some idea of what to expect

Joseph Lipman, President, Summit Management Services has some top tips on managing your event budget effectively:

- Provide as much detail as possible

- Create a document that is easy to read

- Create and extra column to show Cost and also cost overages and savings

- Track changes on budgets

- Create an “additions” column for items added to the program

- Provide a column for approval ; and date added. Also added by “who initials”

- Provide a comprehensive breakdown when possible

- Provide a pie chart at the end for disbursement spend and easy visuals

Part 5: Make Savings When You are Over Budget for Your Event

We have all been in that position of dread when you are told to cut back on the event budget or realise things simply are not stacking up.

So, what do you do when your budget is really tight and you need to find some quick cost savings? Here are a few ways to get spending back under control and deliver under tight budget constraints.

Get to the Crux of the Matter

Firstly you need to understand where your client or boss is coming from. Are they concerned about the event budget because of an organizational hardship or were they disappointed in the revenue or ROI raised last year from it? Are they getting pressure from the C-suite to keep things down or did they fail to see sales from last year’s event? Knowing what’s driving their concern can help you understand the cuts necessary and address it more effectively.

Before you cut, if you have the time, try to increase revenue to balance the columns

- Increase the uniqueness of the attendee experience. Create the “wow” and market it

- Look for new ways to market – like paid social advertising

- Consider other types of attendees who might be a good fit for your event and try marketing to them.

Prioritize Spending: Decide What’s Most Important

When working within a tight or diminished budget, it’s essential to prioritize. What things simply can’t be messed with? Every event has its sacred cows and to remove them, even at significant cost savings, would negatively impact the attendee experience. Maybe it’s a single item like a chocolate fountain or maybe it’s the ‘Last Hurrah’ party at the end but if there’s something that’s a signature expectation, keep it

Instead, try:

- Polling your audience. Find out what they love most. Share this with your client. It’s important they recognize the things that should be placed in the ‘untouchable’ category

- Chose something similar but less costly

- Replace a more expensive item with something less expensive but more intriguing or quirky. For instance, instead of a formal sit-down meal replace it with a heavy apps course with artisanal beverages made to order.

Ditch the Olives

About thirty years ago, back when U.S. airlines served food you didn’t have to pay for, American Airlines decided to remove the olives from their salads. The decision made headlines not because people love olives that much but because it saved the airline about $40,000.

Take a critical look at your event.

- Is there something that can be eliminated to save money that few will notice? Look everywhere for those olives. When you find them, say goodbye and show your client or boss that some corners can be cut.

- Don’t spend money on things that no one notices. Look for little ways to make a big impression. For instance, do you need a live band or will a good playlist of music that appeals to your audience do?

- Cut down on printed materials that get thrown away. Print what you must and go digital on the rest

Understand Some Corners Can’t Be Cut

At this point, you’ve identified signature expenses that can’t be cut without affecting the attendee experience. And you’ve axed the ‘olives.’ Now, among the remaining expenses, you need to understand where quality can’t be compromised and budgets can’t be cut. For instance, have you ever tasted lunch meat that costs $2 a pound? Now go to the deli and have them carve you some up fresh from the $8 a pound roast. Taste the difference there? For people who hide their lunch meat under lots of veggies and condiments, the difference may not matter. For people who like to snack on it on its own, they’ll notice

Same with your budget.

You can avoid bad cuts by:

- Identifying your sacred cows, those things you can’t cut without attendees rioting

- Understanding not only each item’s cost but the impression it makes too

- Asking if the proposed cut fits your event goal or whether it detracts from it

Some areas can be cut because they are hidden behind other things. You can likely eliminate or scale back on:

- Table decor in an event with an impressive light show.

- Centerpieces at a garden party held outside.

- Extra expensive linens that will be covered by something else.

Alternatives can often be identified that will save you money, without compromising on quality. Need some inspiration on where to start?

Look at these simple 17 event budget swaps that will save you money.

Need to cut your event audio visual budget? Here’s how to save money on AV.

Now that the prioritization is done and the harder cuts are made, here are a few quick ways to make big savings in each and every event budget you create…

Part 6: 29 More Creative Ideas to Make Your Event Budget Stretch Further

Don’t let shrinking budgets spoil your event. Use these tips to squeeze the most out of your event budget:

Recruit Volunteers to Save on Staffing Costs

You may be able to provide references or future positions to those volunteers who really stand out or just give them free tickets to the event. Alex Genadinik, entrepreneur coach suggests, “One of the best ways to get free staff for your events is to exchange labor with people who can’t afford to pay for a ticket. There are always people who ask for free tickets, so instead of rejecting them outright, you can have them do a job in exchange for attendance…these jobs can be collecting tickets, manning booths or other simple tasks for which you would have otherwise had to pay someone.”

Consider Co-Operation to Cut Budget Lines In Half

Look for mutual benefit and cost-sharing. Maybe a business has been looking for access to your niche or maybe an industry influencer has a new book to sell. You can use these mutually beneficial arrangements to barter services and sponsorships

Recognize Local Business as Potential for Sponsorship

Point out the advantages of local business. If your event will mean great PR for surrounding local businesses, you might be able to leverage this to reduce your expenses. For instance, a local restaurant may be willing to sponsor the catering if they think there’s the possibility that attendees will visit their establishment

Choose Less Popular Times to Take Advantage of Off-Peak Rates

Change the date or time of the event to one that’s not as popular. (Morning events are cheaper, especially if they can turn around the space and use it for someone else later.) Selecting a less popular date or time ensure you’re in a better situation for negotiating with the vendor

Always Negotiate on Price – If You Don’t Ask, You Don’t Get

Negotiate or barter. Some costs might as well be etched in stone, while others are negotiable. It never hurts to ask about the price. Negotiating and bartering can help you do more with a tight budget. Remember, you may also have a stronger base for negotiation if you’re using the same vendor or supplier for multiple things or events

Need to save a bit more? No problem, we’ve got loads more ideas below:

Sell the Benefits of Co-operation to the Venue

If you have a large event with lots of notoriety, the venue may be so delighted to be linked to a prestigious or groundbreaking event that they may help with some areas of your budget. It’s also important to point out the potential long-term financial benefit of committing to hosting future events at the venue and making it your ‘home’ for the next few years.

Use Local Talent to Save on Travel and Lodgings

Find a speaker or performer who’s already in town. They could be a local or someone involved in another event. This will save on travel expenses.

Cut Expenses by Dropping the Unnecessary Elements of Your Event

If it doesn’t affect your mission or the attendee experience, consider cutting it.

Book in Bulk to Slash Venue Costs

Book multiple events or multiple years at a venue for greater cost savings.

Go Paperless to Save on Printing Costs

Eliminate printing costs and go paperless but be sure your audience will embrace the technology that replaces it. A tech-phobic crowd may take some time to warm up to the idea.

Use In-House Experts to Save on Speaker and Facilitator Costs

Use in-house subject matter experts as group leaders and speakers.

Restrict Bar Times to Save Reduce Bar Costs

Limit the bar in terms of hours, content, or openness. Passing around cocktails will save money compared to an open bar which allows guests to go up whenever they want.

Save Money by Choosing Unusual Venues

Get creative with your venue. Outdoor spaces are often less expensive than renting a hall. However, not all outdoor spaces are cheap. Instead of formal gardens and other traditional outdoor areas, look for ones that are less likely to have hosted events before. As strange as it sounds, alleyways and spots between buildings can become very beguiling with some fauna and white fairy lights. And they’re often inexpensive because people don’t think of them.

Seek Sponsorship for Expensive Items

Seek sponsors for expensive things you can’t cut but make sure you have the data and audience information to make the approach/pitch interesting.

Save Time and Space by Cutting Down on Food

Limit choices in food or don’t serve a meal. You’ll save money on the food, bulky tables won’t be needed so you can save space, less wait staff will be required than if you serve a multi-course meal, and fewer linens as well.

Save Cost With Cheaper Linens

Choose less expensive linens, particularly if they will be covered up by the decor, china, etc.

Cut Vendor Costs by Plugging Their Services

Trade marketing for goods. If you have a large audience, plug the vendors you’re working with for discounts on their services.

Let the Venue Know if There’s a Celebrity Coming – You May Be Able To Make a Deal

If you’re bringing in a celebrity or big-name speaker, let your venue know. They may be willing to work out a deal if they know a VIP will be in the house (and possibly) mention them.

Use Virtual Tickets to Save Food and Beverage Costs

Offer a virtual ticket if the tech costs stack up. You still receive revenue from the attendee, without the food and beverage expenses. If this is a scalable option for you it can be a good income generator.

Raise Money Before the Event by Selling Swag

Sell swag before the event. This gives you an additional revenue stream beforehand when you need it. It also helps increase excitement among event attendees and ensures they have the swag they want before they even get there.

Consider a Smaller Space With Expansion Options

Choose the smaller room with an add-on space. Sometimes it’s less expensive to add an outdoor area to a smaller indoor one with a tent, then it is to opt for the larger conference room. Crunch the numbers and get creative.

Save on Expensive Signage and Printing by Using Event Apps

Go handheld. Save on expensive audio-visual tech by placing everything in the palm of your attendees’ hands through a mobile app. An app may also help you cut down on expenses like hallway signs.

Check Venue Catering Restrictions to Avoid Expensive Mistakes

Understand venue restrictions when pricing. A venue may require you to use their catering, allow you to use caterers on their list, or let you choose whomever you’d like. Make sure you know these costs associated with each venue. You don’t want to be planning on using a bargain caterer only to find out you need to use their pricey list.

Check Venue Furniture Costs Vs External Rentals

Check out inclusive furniture. Some venues come with tables and chairs, while others require renting them. Price out both options to see which will save you the most.

Make Your Attendees Pay For Your Speakers Through Extra Sessions

Get your keynote paid for. If you have a keynote speaker who’s willing to give you a little extra time, you can host a private learning session or meet and greet that attendees pay additionally for. For instance, if your keynote costs $5,000 and a little extra of their time costs you $500, you can easily recoup your $500 and parts, if not all, of your $5,000 by charging VIPs for the opportunity to meet your keynote.

Use Early or Last-Minute Booking To Get Better Prices

Book early or at the last minute. You’ll get the best prices if you book at these times. Of course, last-minute bookings will limit your choices and increase your stress level if you can’t find anything that suits your event. If you have the kind of event you could host anywhere, take the gamble of booking last-minute.

Increase Ticket Prices to Increase Revenue

Increase ticket prices. An increased ticket price means more revenue but you must be sure your audience is willing to pay it.

Create Your Own Promotional Material to Save on Design Costs

Do your own event publishing. There are several free tools to easily create sound promotional material. Search out online resources (first stop – this site!) to find templates, tutorials and tools on how to design badges, brochures, flyers etc. Doing this work yourself provides a lot of flexibility to modify names from registration forms or add new people that showed up at the conference without registering.

Look Out for Public or Community Funds to Help With Your Budget

Depending on the event content there might be a community interested in sponsoring an event with public funds available.

Fast Online Event Budget Calculator: Create and Download your Event Budget

Want to find out quickly if your event is in good financial shape or if an event ideas is viable to proceed?

We have created an online tool so you can quickly work through the different budget headings, add estimated or real figures and instantly see your budget position. Find out if you are breaking even, already making a profit or still have a budget deficit to overcome

Furthermore, once you have added your numbers you can download a copy of the completed budget with the information you have entered and save it to your computer (event budget template xls), ready for future updates.

Don’t want to enter your figures into the online event budget calculator? Jump to the blank event budget download here.

TO DOWNLOAD – add your figures to the online calculator, tick to prove you are not a robot, and download a copy of your calculations to your computer by clicking on the image above.

How To Use The Simple Online Event Budget Calculator

Here is a quick walk through of how the online event budget calculator works:

Income (Revenue):

- Item. The leftmost column represents the name and category of the items

- Qty. Input the number of items you plan to sell

- Price. Input the sale value or expected income per item

- Projected Total. This field will calculate the projected total income per line (Qty x Amount)

Expenditure (Costs):

- Item. The leftmost column represents the name and category of the items (or people) you plan to purchase/hire

- Qty. Input the number of items you plan to purchase/hire

- Price. Input the expected cost per item

- Projected Total. This field will calculate the projected total expenditure per line (Qty x Amount)

Totals:

- Total Income. This value will be automatically calculated, showing actual total income

- Total Expenditure. This value will be automatically calculated, showing the actual total cost

- Total Profit/Loss. These fields are automatically calculated and will indicate how far under or over budget you are

After you have entered your numbers online, tell us you are not a robot and click the download image. you can click on download and You will then have a copy of your own obtain an editable spreadsheet which you can continue to update, where you will be able to input your actual costs and reconcile items.

How To Use The Free Event Budget Template Download (Excel)

Download your blank event budget templateThe downloadable budget template enables you to save and create a more comprehensive budget with projected and actual budget tracking and a comparison between them. If you need further guidance we have outlined it below:

Income (Revenue):

- Item. The leftmost column represents the name and category of the item

- Projected Qty. These figures download from the online calculator if you completed them. If not – input the number of items you plan to sell

- Projected Amount. These figures download from the online calculator if you completed them. If not – input the sale value or expected income per item

- Projected Total. This field will calculate the projected total income per line (Qty x Amount). Make sure the quantity box is completed with the number 1 or more for the formula to calculate

- Actual Qty. Input the number of items you actually sell

- Actual Amount. Input the actual sale value or income per item

- Actual Total. This field will calculate the actual total income per line (Qty x Amount). Make sure the quantity box is completed with the number 1 or more for the formula to calculate

- Comparison Projected/Actual. This field will calculate the difference between projected and actual income, indicating shortfalls

- Comments. Add any important information and notes here.

Expenditure (Costs):

- Item. The leftmost column represents the name and category of the items (or people) you plan to purchase/hire

- Projected Qty. These figures download from the online calculator if you completed them. If not – input the number of items you plan to purchase/hire

- Projected Amount. These figures download from the online calculator if you completed them. Otherwise – input the expected cost per item

- Projected Total. This field will calculate the projected total expenditure per line (Qty x Amount). Make sure the quantity box is completed with the number 1 or more for the formula to calculate

- Actual Qty. Input the number of items you actually purchase/hire

- Actual Amount. Input the actual cost per item

- Actual Total. This field will calculate the actual total expenditure per line (Qty x Amount). Make sure the quantity box is completed with the number 1 or more for the formula to calculate

- Comparison Projected/Actual. This field will calculate the difference between projected and actual costs, indicating shortfalls

- Comments. Add any important information and notes here.

Totals:

- Projected total income. This value will be automatically calculated, showing the total amount of expected income

- Projected total expenditure. This value will be automatically calculated, showing the total amount of expected cost

- Actual total income. This value will be automatically calculated, showing actual total income

- Actual total expenditure. This value will be automatically calculated, showing the actual total cost

- Comparison Projected/Actual. These fields are automatically calculated and will indicate how far under or over budget your totals are

You can use this handy conference budget template excel / event budget template excel time and time again to keep your event financials on track!

In Conclusion

Getting your budget right is one of the most critical things you’ll do as an event planner. The event budgeting process is fraught with opportunities for things to go awry. Knowing how to create a successful budget, how to cut should need arise, and what mistakes to avoid will help you achieve greater levels of success

Now onto you:

- Do you have a tip to make this page better or want to use any of the statistics? Send an email to [email protected]

- Do you have more tips and advice to add about how to manage your event budget more efficiently? Comment below

- Do you have a colleague who may benefit from reading this page? Share it with them