Skift Take

By now, the impact of the pandemic has reverberated throughout the events industry. CEIR has been tallying the hits and losses for the US, and the first quarter results are in: devastation confirmed. Here’s what you need to know.

MWC in Barcelona and ITB Berlin were among the first large-scale exhibitions to cancel amid controversy and uncertainty surrounding the healthcare implications of hosting large-scale events with hundreds of thousands of attendees from all over, but the writing was on the wall, and soon everyone had read it.

The events industry ground to a halt, and only now — three months later — are speculations about when things might return to normal sounding more like optimism than delusion.

It’s likely that we won’t have a full understanding of the broader economic impact of the lockdown on our industry, but the Center for Exhibition Industry Research has just released the initial figures for the US, and they are what you would expect: dismal.

The Results Are In But Not Good

CEIR reports that nearly three quarters of the US events in March were cancelled. The rest were postponed, and many of those may be cancelled later.

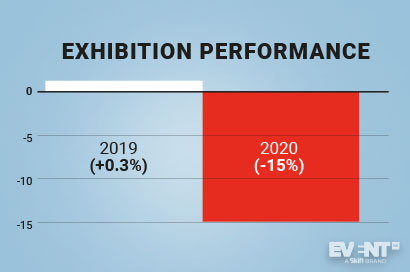

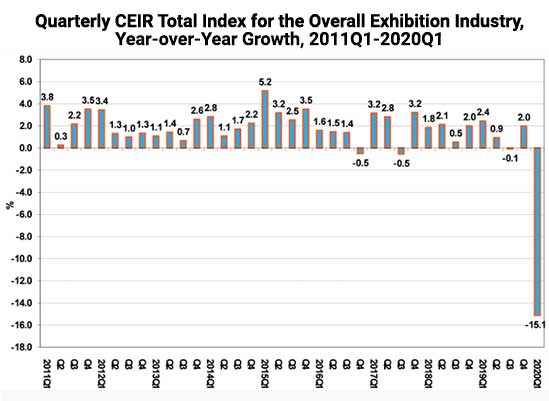

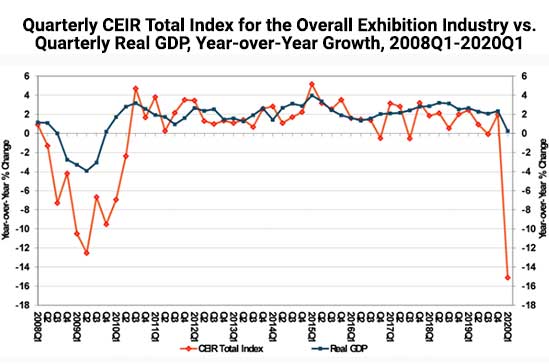

CEIR measures the performance of the exhibition industry in their CEIR Total Index, which “registered a record 15.1% decline from a year ago, compared to a modest 0.3% year-over-year gain of inflation-adjusted GDP.”

Credit: Center for Exhibition Industry Research

Credit: Center for Exhibition Industry Research

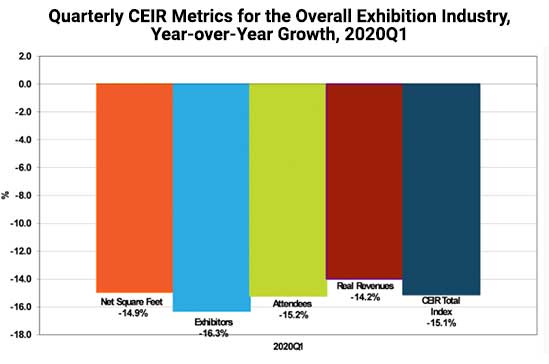

This dramatic decline was true of all exhibition metrics in the first quarter:

“Exhibitors and attendees posted the largest drop of 16.3% and 15.2%, respectively. Net square feet (NSF) decreased 14.9% whereas real revenues (nominal revenues adjusted for inflation) tumbled 14.2%.”

Credit: Center for Exhibition Industry Research

Prior to March, the exhibition industry was on a modest upward trajectory that followed the pattern of previous years. Until cancellations swept all events into later quarters or 2021, the Total Index had grown by 0.3%.

What Does the Future Hold?

It’s too early to tell what sort of recovery we can expect, but those who evaluate it will have the task of making two kinds of analysis: one that compares the future performance of the industry to the norm given existing models based on data from 2019, and one that accounts for the new normal of social distancing. The latter will inevitably present the challenge of requiring its own benchmarks — a daunting prospect considering the total lack of precedent and rapidly evolving information defining our current situation.

Moreover, any evaluation of the exhibition industry’s ability to get back on its feet will need to account for desperately needed Federal support, which itself depends on the government’s waking up to the reality that events are a major economic driver worth, in 2019, $101 billion to U.S. GDP.

From CEIR CEO Cathy Breden as quoted in CEIR’s press release:

“It is incumbent for Federal financial rescue programs to extend to event organizers and service providers so that the exhibition industry can help buoy economic recovery by helping keep businesses alive and help people keep their jobs and put millions of people back to work.”

Despite the handling of the pandemic, the strife over a history of systemic racism, and general dissent within the Republican party, perhaps the US government’s seeming prioritization of the economy can allow us to remain optimistic that we will receive the lifeline we need to get back in business safely and responsibly.

In the meantime, we encourage planners to turn to virtual events, which — in addition to being a lifeline we have control over — have a number of benefits from a much-needed increase in event inclusivity to a dramatic increase in attendee reach and engagement.