Skift Take

UFI’s Global Barometer provides much-needed clarity for the exhibitions industry in a Covid-era defined by uncertainty. Which areas have been hit the hardest, and how badly? Here are the highlights.

UFI’s biannual research project, Global Barometer, seeks to take the pulse of the exhibition industry and provide a detailed statistical analysis of exhibitions by area. The June 2020 edition, which surveyed 459 companies in 62 regions, focuses on the undeniable impact of the coronavirus pandemic, which has devastated events as an industry.

Research like this is essential for establishing not just the impact, but key initial benchmarks that can be used to assess growth and recovery. It provides context to our analyses of different sectors — what they’re doing right, what they’re doing wrong, and what market factors bring to bear on their success.

Optimism Gave Way to Realism

The industry’s initial optimism that the virus was limited to China proved unfounded as the percentage of companies operating normally fell from 85 percent in January to 5 and 6 percent by April. “For both April and May,” UFI reports, “[73 percent] of companies worldwide declared ‘no activity’.”

Even now, “a majority of companies [expect] ‘local’ and ‘national’ exhibitions to open again during the second half of 2020” to a reduced level, but with herd immunity seeming less and less like a possible salvation, it’s no surprise that most companies don’t expect international events to open before 2021.

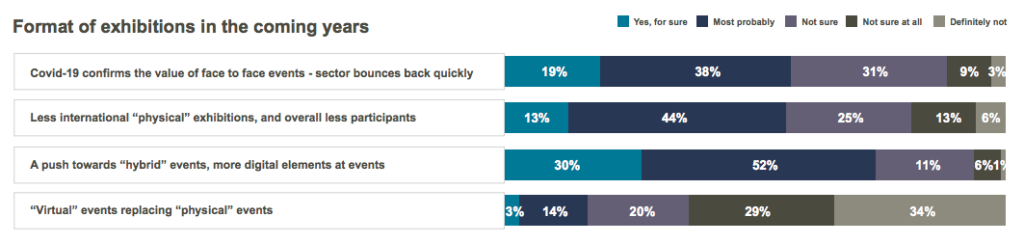

Nevertheless, companies maintain that face-to-face events are irreplaceably valuable: “57 percent are confident that ‘COVID-19 confirms the value of face-to- face events’” and expect a quick return as soon as it’s permitted. 43 percent, however, have less faith in the industry’s recovery potential.

Credit: UFI Global Exhibition Barometer, July 2020

Exhibitions Are Taking the Brunt of the First Wave

The “Impact of COVID-19 pandemic on the business” is the most significant concern cited (27 percent), outranking both the “State of the economy in home market” (21 percent) and “Global economic developments” (18 percent).

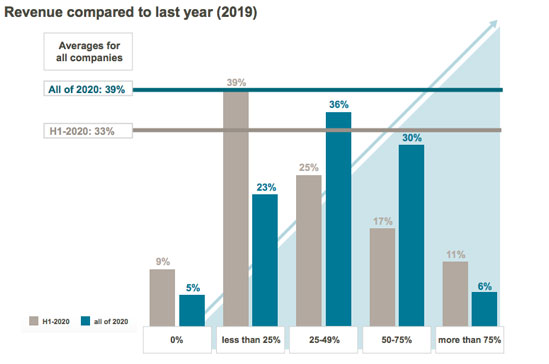

Only about a third of the expected revenue for the first half of 2020 has been realised, and the hope for the remainder of the year is an ambitious 39 percent of those of 2019. Perhaps ironically, 39 percent is also the portion of participating companies who experienced a loss.

“[Only] 7 percent of companies currently expect a stable or increased profit for 2020.”

Credit: UFI Global Exhibition Barometer, July 2020

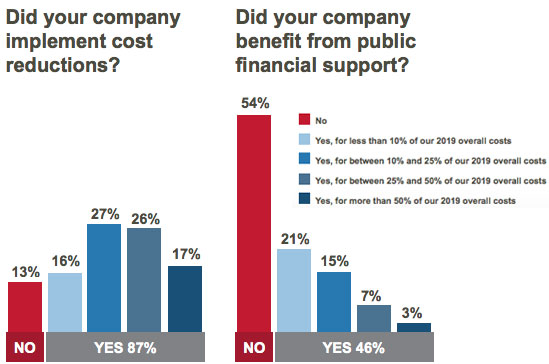

87 percent of companies cut their costs — 17 percent of them halved them — and 56 percent received no public financial support. For the majority of those that did “it related to less than 10 percent of their costs.”

Credit: UFI Global Exhibition Barometer, July 2020

Pivoting to Virtual Is Not as Easy as It Sounds

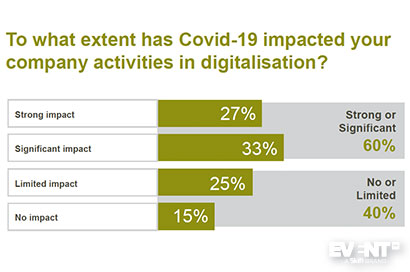

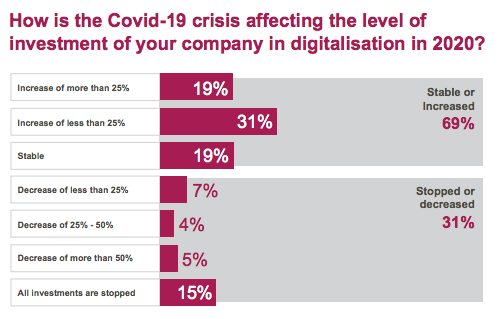

82 percent of participating companies recognize “A push towards hybrid events, more digital elements at events” (30 percent “Yes, for sure” and 52 percent “Most probably”).

In fact, half the participating companies are boosting their investments in digital options — at the cost of reduced investments in diversity and sustainability (55 percent and 54 percent respectively). This shift in priorities is a necessary survival strategy. “44 percent [have] stopped all of their investments […] and they will decrease for another 32 percent of companies.”

Credit: UFI Global Exhibition Barometer, July 2020

However, as virtual events are the safest way forward for the time being, investing in virtual engagement remains a key element of many exhibitions’ survival:

“[Everyone] is aware that this crisis will lead to major changes in the way exhibitions are produced, especially with a push towards more digital elements before, during, and between events.”

– Kai Hattendorf, Managing Director and CEO, UFI

This is far from a consensus in the industry, though, and opinions vary wildly from region to region. Notably, when participants were asked whether they agree with the possibility of “Virtual events replacing physical events,” European companies largely disagreed (80 percent) while only 50 percent of North American companies do.

Some Areas Were Hit Harder Than Others

In the Asia-Pacific region, “only 73 percent of companies declared a ‘normal’ level in January compared to a minimum of 85 percent in all other regions” — a figure that dropped to 45% by February.

In the Middle East, Africa, most companies don’t even expect a comeback for local exhibitions until 2021. In these regions, the expected annual revenue for 2020 is 31, compared to 39 percent in the Asia-Pacific region and 44 percent in Europe and North America. Nearly half of participating companies in the Middle East and Africa are expecting a loss in 2020.

The same is true in Central and South America, where the expected revenue is 33 percent of 2019’s. Moreover, 60 percent of Central and South American companies have stopped all their investments.